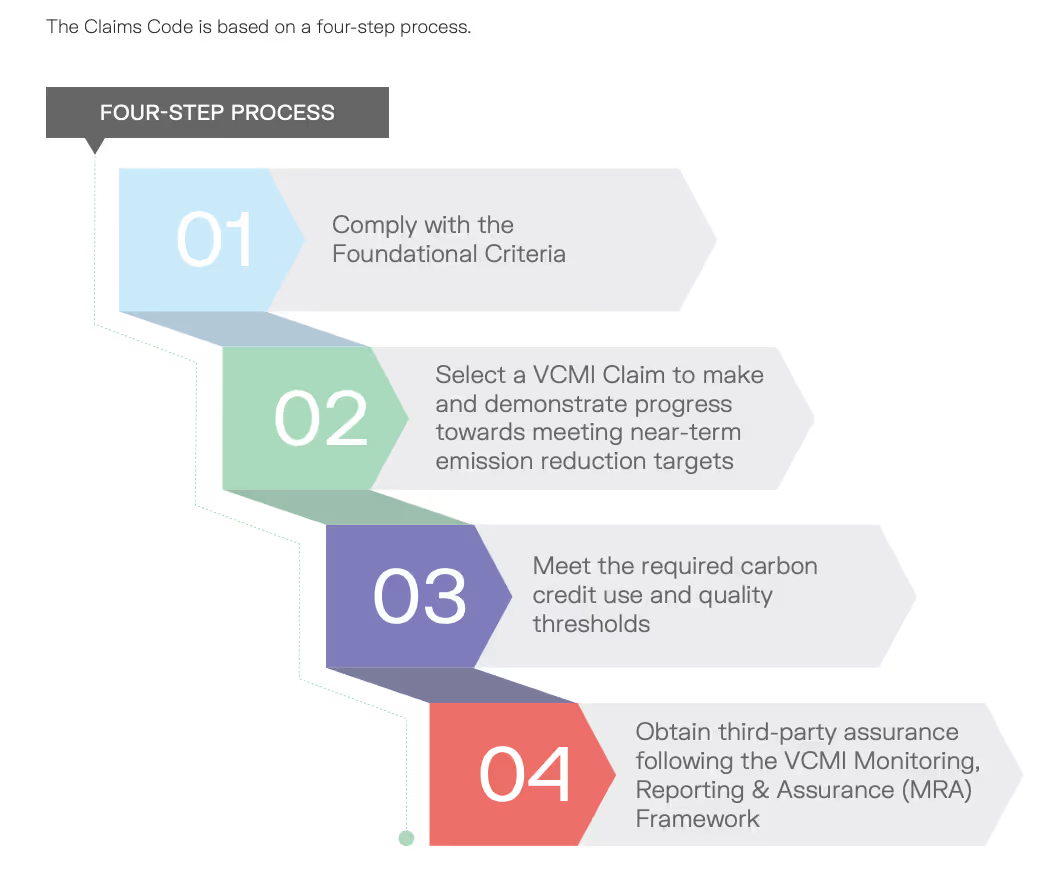

The Voluntary Carbon Markets Integrity Initiative (VCMI) recently shared updated guidance for companies looking to make claims based on the use of carbon credits within broader decarbonization plans. The new additions follow the initial launch of the Claims Code of Practice in June, which outlined the four-step process companies must follow to make a VCMI-approved claim.

The latest updates offer new branding for claims, a beta version of a new claim type, and perhaps most importantly, the Monitoring Reporting and Assurance (MRA) Framework that will serve as the roadmap for meeting the foundation criteria.

These updates move the Claims Code of Practice into an actionable initiative that companies can now leverage as they engage with the voluntary carbon market.

What’s new for the Claims Code of Practice?

A fresh brand for claims:

“Carbon Integrity Claims” will be the new, standalone brand distinction a company can use to demonstrate they have achieved a claim status. On top of new names, the credit purchase threshold for the three tiers have been adjusted slightly from the last iteration:

- Carbon Integrity Platinum: purchase and retirement of credits equal to 100% or more of a company's remaining emissions (previously “VCMI Platinum”)

- Carbon Integrity Gold: purchase and retirement of credits equal to 50% or greater of a company’s remaining emissions (previously 60% or greater, “VCMI Gold”)

- Carbon Integrity Sliver: purchase and retirement of credits equal to 10% to 50% or greater of a companies remaining emissions (previously 20% to 60%, “VCMI Silver”)

Detailed framework for meeting claim requirements:

The new MRA Framework holds the meatier details buyers and stakeholders have been waiting for, mapping out the assurance and reporting requirements that must be used to complete the four-step process and setting the tone for the rigor and integrity this process will provide.

Here are some of the most notable inclusions within the MRA Framework:

- Credit purchasing: The original Claims Code stipulated that CORSIA-eligible credits could be used to make a claim until ICVCM finalizes the Core Carbon Principles (CCP) standards and delivers CCP-approved credits. The updated guidance expands the scope of currently-eligible credits to include any carbon credit, so long as the purchasing company can “disclose how existing due diligence processes align with ICVCM’s CCPs”. This shift is meant to help accommodate businesses who already have credit contracts in place for the next two years, and to generally increase the available options on the market for buyers interested in making VCMI claims in the coming months. However, this expansion also creates more subjectivity, leaving it in the hands of businesses applying for claims to determine if and how their carbon credit project aligns with the CCPs.

- Setting science-aligned targets: If a company is working towards an official SBTi approved target, they will have a full year to get their target approved. An outstanding question is whether VCMI is able or willing to accommodate individually set targets for businesses who have been tracking their own decarbonization not set through SBTi.

- Emissions inventorying and reporting: The new requirements for reporting emissions footprints are thorough: in addition to quantifying a business’s footprint year on year, companies must calculate, verify, and report on the difference between their base year and the current year emissions. VCMI requires limited assurance for scope 1 and 2 footprints, and public disclosure for scope 3 (scope 3 data collection is much more complex for businesses so limited assurance can be difficult to achieve). This allows businesses to track progress towards their reduction goal year on year. Businesses are also required to disclose whether or not they are meeting their targets, although there is little guidance on what happens if a business is not on track.

- 3rd party assurances: Third-party validation of a business’s work is foundational to VCMI’s MRA Framework. VCMI worked to pull their requirements from many leading standards already in the market, including the GHG Protocol and SBTi, and will in some cases allow companies to provide evidence of “previously obtained third-party assurances” to avoid unnecessary or duplicative reporting. Given the amount of scrutiny over climate claims, third-party assurance is seen as best practice for validating the environmental work that an organization has completed and is an integral part of Patch's trust and safety process for vetting projects.

- Financial allocations and governance: Requirements for demonstrating that corporates’ financial allocation, governance and public policy strategies are aligned with net-zero objectives are an important new addition to the MRA Framework that had not been specified in previous documents. Companies must disclose the financial allocation for emissions mitigation across their value chain through a number of data points, including the percentage of annual revenue or expenditures dedicated and earmarked for emissions mitigation. Companies must also demonstrate how their governance structure, through board members and senior management, oversees this progress. Lastly, companies must submit a public statement “describing how their advocacy activities are consistent with the goals of the Paris Agreement.”

- Timelines: All claims and assurance must be submitted within nine months of the previous emissions year. Claims are valid for one year, which will be reflected within the Carbon Integrity mark, or claim logo, that will be provided.

A new option for scope 3 compensation:

VCMI also unveiled a “beta” version of a new claim type, intended to create a valid pathway for companies who haven’t fully reached their scope 3 reduction targets (notoriously the most complex to both track and reduce) to continue to take action using carbon credits. The proposal suggested companies can use carbon credits to bridge the gap between their most recently reported scope 3 emissions and the expected scope 3 emissions for the same year based on their science-aligned target.

The process for new businesses setting and reaching scope 3 targets often takes time. The Scope 3 Flexibility claim helps build in flexibility for businesses who are in earlier stages of their plan, as it accounts for the fact that reductions are not always linear and that year-on-year progress might not exactly match the company's first goal.

Guardrails are set to help ensure this is not a method to avoid reduction action: scope 1 and 2 targets must be met, the credit bridge cannot exceed 50% of scope 3, and that percent must decline year on year. This claim would also require disclosure of the target emissions and the actual emissions so that the level of compensation used is public.

While the Scope 3 Flexibility claim is not yet actionable for companies, a roadmap was shared to develop and finalize the claim by the end of 2024.

What’s next?

VCMI is now encouraging companies to submit documentation to their “Claims Reporting Platform” to begin the process of making a claim.

Patch’s automated reporting process makes sharing credit purchase details for a Carbon Integrity Claim seamless. If a Patch buyer indicates they’re working towards a claim, Patch will automatically send a complete report of your purchase to submit directly to VCMI. Similarly, CCP-aligned credits will be clearly marked on the Patch platform as ICVCM finalizes their criteria. Patch can also assist with credit procurement prior to CCP roll-out.

If you’re considering purchasing credits to make a Carbon Integrity Claim, or have questions about the standards landscape of the voluntary carbon market overall, reach out. The Patch team works closely with many of these bodies, including serving on the VCMI Stakeholder Forum, and welcomes open discussion on creating a more effective and efficient carbon market.